refinance transfer taxes maryland

30 year fixed mortgage calculator maryland refinance. Somerset County Mortgage Calculator.

Allegany County Tax Exemption.

. How much would be the transfer tax on refinancing in Maryland. This tax applies to both instruments that transfer an interest in real property and instruments that. The tax is based on the consideration paid consideration is the purchase price or in some cases the amount of a mortgage that the new owner agrees to pay for the real property.

Thank You For Your Service. Ad Were Americas 1 Online Lender. Maryland County Tax Table.

Therefore no new deed transfer taxes are paid. Easily calculate the Maryland title insurance rate and Maryland transfer tax. However a change to Maryland law in 2013 extended the refinancing exemption to.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Explanation of county transfer and state recordation taxes county transfer tax is a privilege tax that is assessed by prince georges county on documents being recorded in land records.

Or ii domestic partners or former. From about the end of July until the end of September the Countys telephone line 240 777-0311 can be very busy. Baltimore City County Mortgage Calculator.

Transfer Tax 10 5 County 5 State Property Tax 1108 per hundred assessed value 976 County 132 State SAINT MARYS COUNTY Recordation Tax 800 per thousand. D 1 An instrument of writing that transfers property between the following individuals is not subject to recordation tax. Apply Pre Approved in 24hrs.

Ad Mortgage Refinance Easy Process 100 Online Fast Approval Best Plans for 2022. I spouses or former spouses. Garrett County Mortgage Calculator.

Special Pricing Just a Click Away - Get Started Now See For Yourself. Ad We Honor our Veterans and Have Served Them For Over 16 Years. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Including the MD recordation tax excise stamps for a home purchase and refinance mortgage. This is a refinance Paying off existing loanor modification of a property that is NOT your principal residence. To accommodate the number of telephone calls the system holds calls.

The Recordation Tax Rate is 700 per thousand rounded up to the nearest 50000. Or same as Sate rate ¼ if first time MD Homebuyer. 300 credit for owner occupant.

Apply in same fashion as MD transfer tax for 1st time MD Homebuyer. State Transfer Tax is 05 of transaction amount for all counties. Historically Marylands refinancing was only available for residential transactions.

Saint Marys County Mortgage Calculator. Ad 2021s Trusted Mortgage Refinance Reviews. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Mortgage Calculator Maryland - If you are looking for options for lower your payments then we can provide you with solutions. Finance Billing Payments Recordation Tax Recordation Tax County collection of Recordation County Transfer Tax and the stamping of deeds for satisfaction of county obligations. You are the original mortgagor or assumed the debt from the original.

When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. Refinancing Can Be Easy. Compare 2022s Top Refinance Mortgage Landers.

Comparisons Trusted by 45000000. Ad Compare Top Mortgage Refinance Lenders. If the home buyer is a first-time home buyer 12.

On an existing home resale it is customary in Maryland for the transfer and recordation taxes to be split evenly between the buyer and seller. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower.

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Maryland Transfer And Recordation Tax Edgington Management

Transfer Tax Who Pays What In Washington Dc

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

How Significant Is The Proposed Recordation Tax Rate Increase In Howard County Scott E S Blog Archive

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

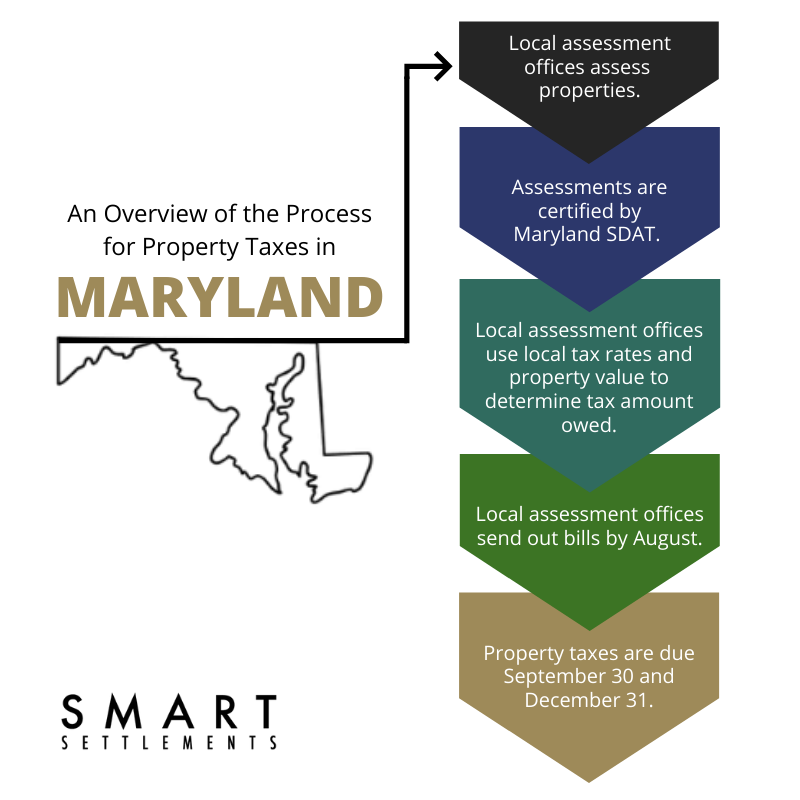

Smart Faqs About Maryland Property Taxes Smart Settlements

Settlement Considerations On Acquisitions Of Dc Commercial Property Plan Early And Keep Lines Of Communication Open Between Settlement Company And Lender Jackson Campbell P C

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate